In this particular in depth guideline, we will delve into your nuances of getting a $4000 particular bank loan. From being familiar with the appliance system and eligibility standards to evaluating lenders offering personalized loans and exploring repayment alternatives, we aim to equip you with the expertise to help make an informed monetary conclusion.

However, just because that you are prequalified won't signify you are confirmed a mortgage. The lender will likely need to get a more in-depth check out your economic track record and the information you submitted, that's initiated by your acceptance of the first supply.

No matter whether you might have fantastic or bad credit history, TriceLoans considers different things past just your credit history rating. The web lender provides individual loans with prompt approval and rapidly funding, catering to borrowers with various credit history backgrounds.

The way a $4,000 particular mortgage performs is you get the bank loan principal if the lender approves your application and disburses the funds. You need to repay the $4k principal around a established time period and any desire expenses and fees which could implement.

Once you're permitted for the $4,000 installment loan, the lender will deposit the money into your account, and you may start generating payments according to the agreed timetable until finally the financial loan, moreover curiosity, is paid out off.

Even so, you should very carefully Appraise your ability to repay the mortgage just before making use of. Particular financial loans include fastened month-to-month payments, and it’s vital making sure that it is possible to meet your obligations to avoid late expenses or damage to your credit history score.

You will discover no less than 12 kinds of personal loans that consumers could think about when implementing for just a mortgage. Your own circumstances can dictate irrespective of whether a $4k financial loan is good for you.

A current get more info examining account is important for the transaction. The personal loan amount of money is normally deposited straight into this account, and repayments are usually withdrawn from it.

You may have to apply to multiple places, acknowledge a large desire level, incorporate a cosigner, or pledge stability. This is because, through the lender's point of view, you are a larger hazard than borrowers with far better credit scores. To attenuate their danger they'll request an additional borrower, safety they can use to repay the bank loan if you do not, or charge higher prices.

Should you be consolidating financial debt by paying off other debts, this might have a favourable impact on your debt-to-income ratio (DTI). Possessing a person payment instead of many tiny payments might imply that you will be paying much less on a monthly basis so you'll have A neater time producing your payments.

WalletHub users Possess a prosperity of information to share, and we motivate Every person to do so even though respecting our content recommendations. This issue was posted by WalletHub. WalletHub would not endorse any individual contributors and cannot assurance the standard or trustworthiness of any facts posted. No matter no matter if an establishment or professional is usually a compensated advertiser, the existence of information on WalletHub would not represent a referral or endorsement on the establishment or Experienced by us or vice versa. We work hard to demonstrate up-to-date merchandise terms, however, this details isn't going to originate from us and thus, we don't promise its precision. Actual phrases could differ. Just before distributing an software, constantly validate all stipulations While using the giving institution. Make sure you let us know when you see any dissimilarities.

After accepting a mortgage provide, the lender will possible bear the underwriting method, which ordinarily includes a tricky credit rating pull and evaluation of your respective monetary and private history. For the duration of this phase, the lender may ask for supporting documentation for example evidence of profits or residency.

If you need a $4k bank loan, Lantern by SoFi can help you Assess particular loan rates. Just supply fundamental details about by yourself, and Lantern can guide you in the process to make an application for a personal loan With all the lender of your respective decision.

Personal financial loans, regular installment financial loans, and bank card funds advancements are the key kinds of $4,000 loans. Every single of these bank loan types caters to different economical needs and scenarios, giving flexibility for borrowers.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Jennifer Grey Then & Now!

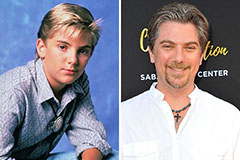

Jennifer Grey Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!